Please note that the financials in this complete free business plan are completely fictitious and may not match the text of the business plan below. This free business plan demonstration purposes only. If you are interested in purchasing the completed editable MS Word and Excel documents for this business plan, please click the button below! Also, the text of the business plan is formatted with a fully automated table of contents.

1.0 Executive Summary

The purpose of this business plan is to raise $100,000 for the development of a business that manages a network of ATM machines while showcasing the expected financials and operations over the next three years. ATM Sales and Service Company, Inc. (“the Company”) is a New York based corporation that will manage several stand alone ATM machines throughout grocery stores and malls throughout the state. The Company was founded by John Doe.

1.1 Products and Services

As stated above, the Company’s state of the ATM machine machines will provide customers with access to cash. The Company will provide location partners with a 30% revenue share for all income derived from each ATM machine.

The Founder, prior to the onset of operations, will develop relationships with malls, grocery stores, and property manages for the distribution of the Company’s ATM machines.

The third section of the business plan will further describe the services offered by ATM Sales and Service Company, Inc.

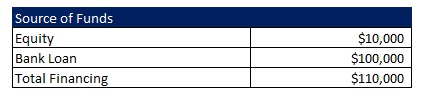

1.2 The Financing

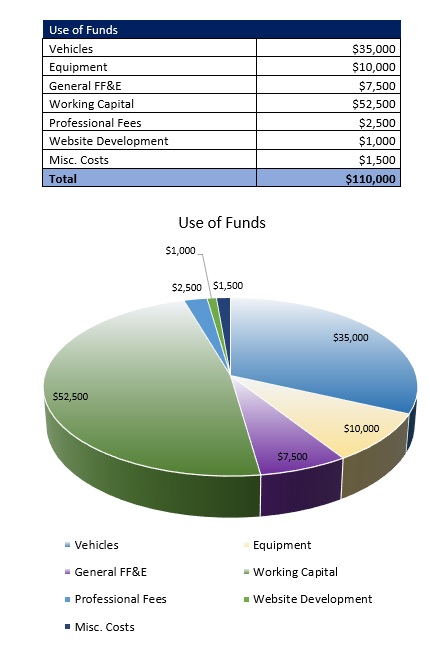

Mr. Doe is seeking to raise $100,000 from as a bank loan. The interest rate and loan agreement are to be further discussed during negotiation. This business plan assumes that the business will receive a 10 year loan with a 9% fixed interest rate. The financing will be used for the following:

- Acquisition and distribution of at least 8 ATM machines

- Financing for the first six months of operation.

- Capital to purchase the inventory

Mr. Doe will contribute $10,000 to the venture.

1.3 Mission Statement

Mr. Doe’s mission is to provide quick access to cash to customers while concurrently ensuring that business’ and organizations’ that allow the Company’s machines on site are compensated for their rental of space.

1.4 Management Team

The Company was founded by John Doe. Mr. Doe has more than 10 years of experience in the financial services industry. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

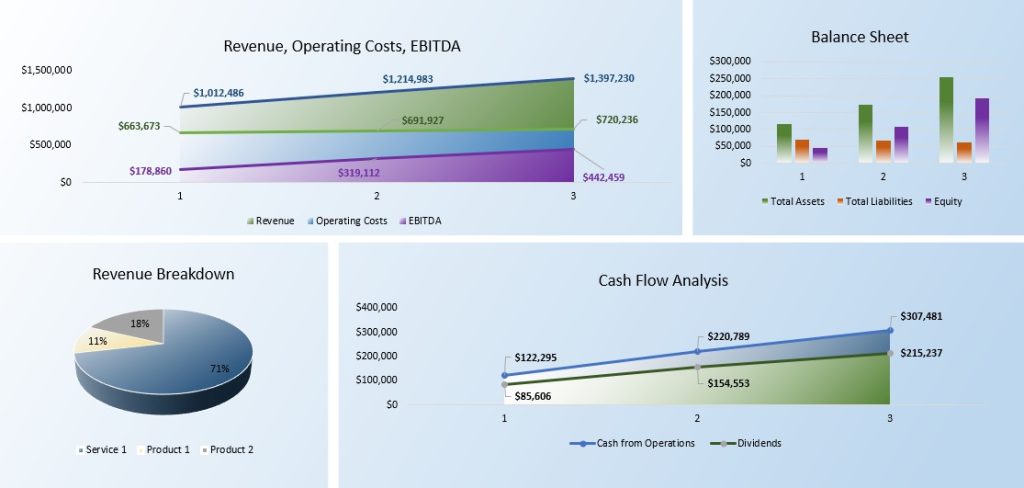

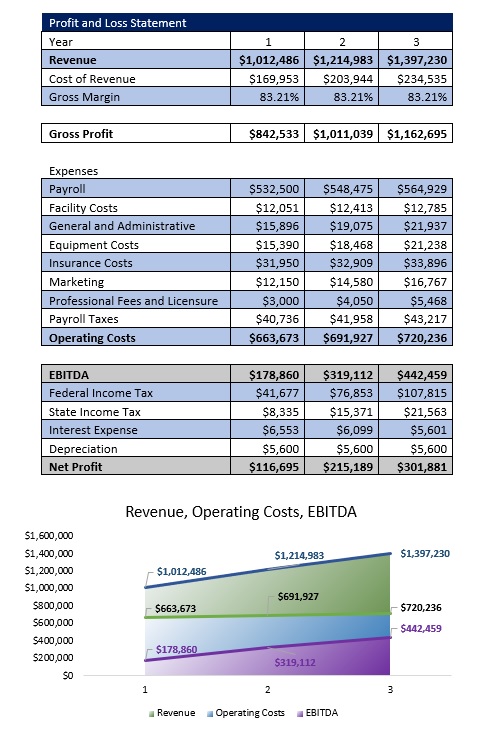

1.5 Sales Forecasts

Mr. Doe expects a strong rate of growth at the start of operations. Below are the expected financials over the next three years.

1.6 Expansion Plan

Over the next three years, Mr. Doe intends to reinvest the after tax cash flow of the business into the purchase of new ATM machines which will substantially increase the revenues of the business. The Company will continually source new high traffic locations where the business can place additional ATM machines.

2.0 Company and Financing Summary

2.1 Registered Name and Corporate Structure

ATM Sales and Service Company, Inc. The Company is registered as a corporation in the State of New York.

2.2 Required Funds

At this time, ATM Sales and Service Company, Inc. requires $100,000 of debt funds. Below is a breakdown of how these funds will be used:

2.3 Investor Equity

Mr. Doe is not seeking an investment from a third party at this time.

2.4 Management Equity

John Doe owns 100% of ATM Sales and Service Company, Inc.

2.5 Exit Strategy

If the businesIf the business is very successful, Mr. Doe may seek to sell the business to a third party for a significant earnings multiple. Most likely, the Company will hire a qualified business broker to sell the business on behalf of ATM Sales and Service Company, Inc. Based on historical numbers, the business could fetch a sales premium of up to 4 times earnings.

3.0 Products and Services

As stated in the executive summary, the Company will be actively engaged in the business of developing a network of Automated Teller Machines (ATMs) that will be placed among several locations within the New York metropolitan region. These machines will provide customers with the ability to make financial transactions from their debit or credit cards including cash withdrawals and transfers of money to separate accounts.

Management has already sourced a distributor that will provide ATM machines that will be used in conjunction with the business.

In exchange for placing an ATM machine on a property or within a store, the Company will provide a share of the revenues generated from ATM transactions.

ATM Servicing

The Company will maintain service contracts with a nationally recognized ATM machine service business that renders these services.

4.0 Strategic and Market Analysis

4.1 Economic Outlook

The business of ATM machine management is a relatively simply business. This section of analysis will detail the overall economic climate, and the interest rate environment, and the industry.

Currently, the economic market condition in the United States is moderate. Unemployment rates have declined while asset prices have risen substantially. However, the low pricing point of the Company’s ATM usage services will ensure that the Company can remain profitable despite the current issues with the economy.

4.2 Industry Analysis

Within the United States, there are more than 7,000 companies are actively engaged in the sale, management, and servicing of ATM machines. In each of the last five years, these companies have aggregately generated more than $14.4 billion of revenues while providing jobs to more than 125,000 people. Total payrolls in each of the last five years have exceeded $5 billion.

This is a mature industry, and the expected growth rate during the next five to ten years is expected to mirror that of the general economy.

4.3 Customer Profile

Among the retailers that will serve as locations for the Company’s ATMs, Management has outlined the general characteristics of this user base:

- Operates in a retail capacity.

- Is located within the New York metropolitan area.

- Annual revenues of $200,000 to $1,000,000+

- Is seeking to expand revenue base through ancillary onsite services via the use of ATM machines.

4.4 Competitive Analysis

At this time it is difficult to determine the competition that the Company will face as it progresses through its operations. There are a number of companies that maintain ATM machines within Grocery Stores, Apartment Buildings, and Malls.

5.0 Marketing Plan

Below is a description of the marketing plan that ATM Sales and Service Company, Inc. will use to establish its locations throughout the State of New York.

5.1 Marketing Objectives

- Establish relationships with property management firms, grocery stores, and malls.

- Maintain strong relationships with ATM machine equipment wholesalers throughout the State of New York.

5.2 Marketing Strategies

Marketing for the business’ ATM machines will be very limited. The Company’s marketing campaigns will be limited to developing relationships with property management firms. Prior to the onset of operations, Mr. Doe will approach these businesses for placing ATM machines on their properties.

The Company intends to also develop a website that will showcase the operations of the business, how a potential location can work with ATM Sales and Service Company, Inc, and relevant contact information. As the economy is currently sluggish, many property management firms and related organizations are looking for ways to establish secondary lines of revenue; namely through the rental of space to ATM machine businesses.

Management will also directly approach newly developed properties that are looking to expand their secondary revenue streams as well.

5.3 Pricing

In this section, describe the pricing of your services and products. You should provide as much information as possible about your pricing as possible in this section. However, if you have hundreds of items, condense your product list categorically. This section of the business plan should not span more than 1 page.

6.0 Organizational Plan and Personnel Summary

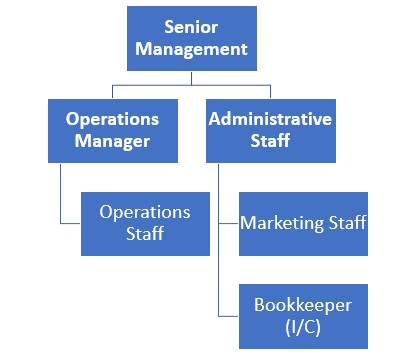

6.1 Corporate Organization

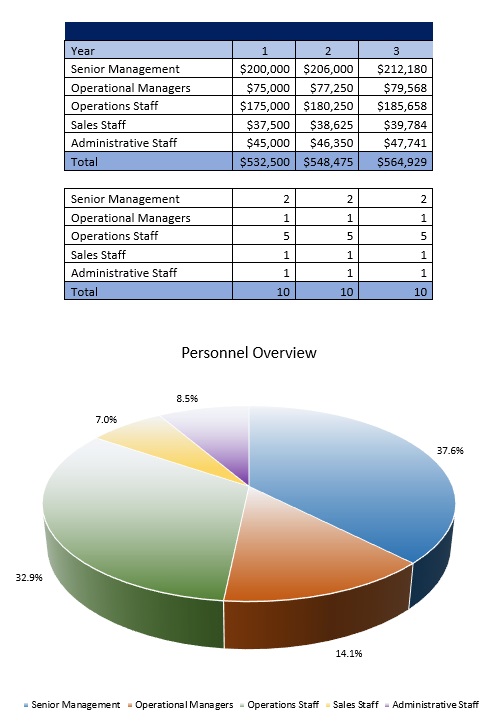

6.2 Organizational Budget

7.0 Financial Plan

7.1 Underlying Assumptions

The Company has based its proforma financial statements on the following:

- ATM Sales and Service Company, Inc. will have an annual revenue growth rate of 16% per year.

- The Owner will acquire $100,000 of debt funds to develop the business.

- The loan will have a 10 year term with a 9% interest rate.

7.2 Sensitivity Analysis

The Company’s revenues are not sensitive to changes in the general economy. The demand for people to have access to physical cash does not fluctuate. As such, Management will be able to continually grow the business despite the external business climate.

7.3 Source of Funds

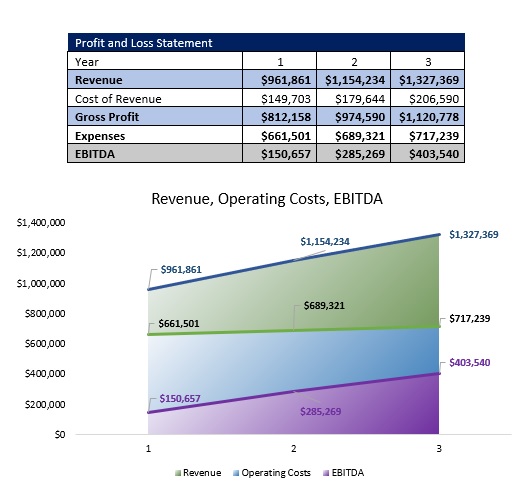

7.4 Profit and Loss Statement

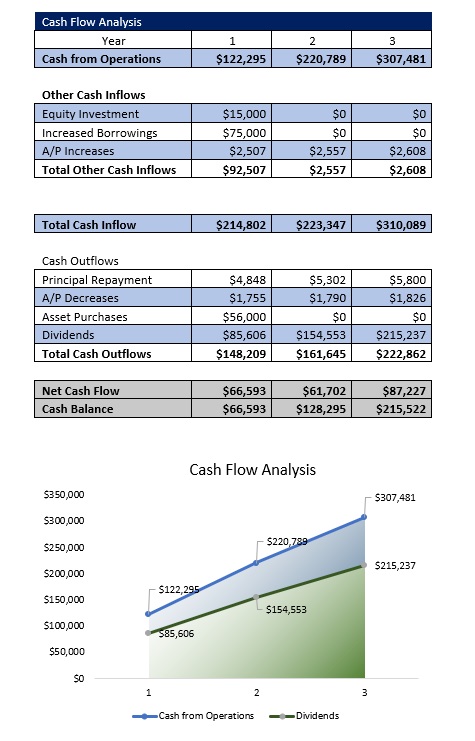

7.5 Cash Flow Analysis

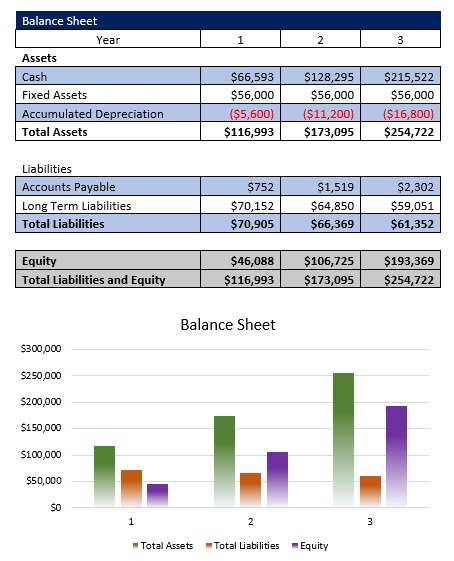

7.6 Balance Sheet

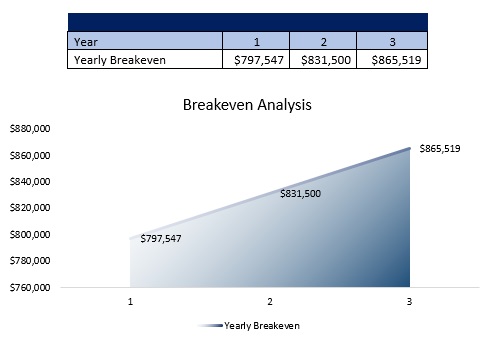

7.7 Breakeven Analysis

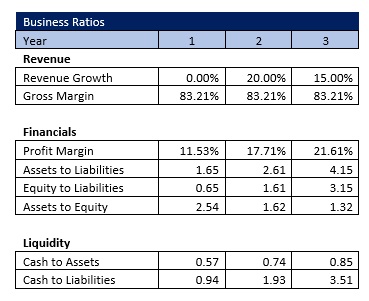

7.8 Business Ratios