Please note that the financials in this complete free business plan are completely fictitious and may not match the text of the business plan below. This free business plan demonstration purposes only. If you are interested in purchasing the completed editable MS Word and Excel documents for this business plan, please click the button below! Also, the text of the business plan is formatted with a fully automated table of contents.

1.0 Executive Summary

The purpose of this business plan is to raise $100,000 for the development of a bail bonding company while showcasing the expected financials and operations over the next three years. Bail Bonding, Inc. (“the Company”) is a New York based corporation that will provide bail bonding services and bounty hunting within the Company’s targeted market of New York. The Company was founded by John Doe

1.1 Products and Services

The primary revenue center for the business will come from the ongoing bail bonding services rendered to people that have been arrested and must put up bond in order to be released on bail. On each transaction, the Company will earn a fee equal to 10% of the aggregate bond set forth by the court. The business will also generate secondary streams of revenue by acting in a licensed bounty hunter capacity among individuals that have fled after Bail Bonding, Inc. put up the appropriate collateral for an individuals bail bond. The third section of the business plan will further describe the services offered by Bail Bonding, Inc.

1.2 The Financing

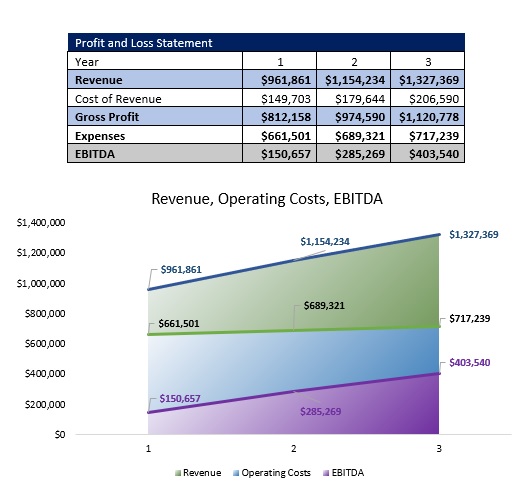

Mr. Doe is seeking to raise $100,000 from as a private investment. The business is seeking to sell a 45% interest in the business in exchange for the requisite capital sought in this business plan. The investor will also receive a seat on the board of directors and a regular stream of dividends. The financing will be used for the following: • Development of the Company’s Bail Bonding location. • Financing for the first six months of operation. • Capital to purchase a company vehicle.

1.3 Mission Statement

Bail Bonding, Inc.’s mission is to develop a business that provides outstanding bail bonding services to people within the New York metropolitan area.

1.4 Management Team

The Company was founded by John Doe. Mr. Doe has more than 10 years of experience in the law enforcement industry. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

1.5 Sales Forecasts

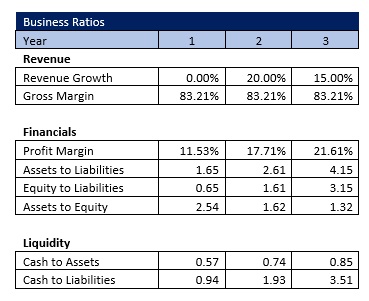

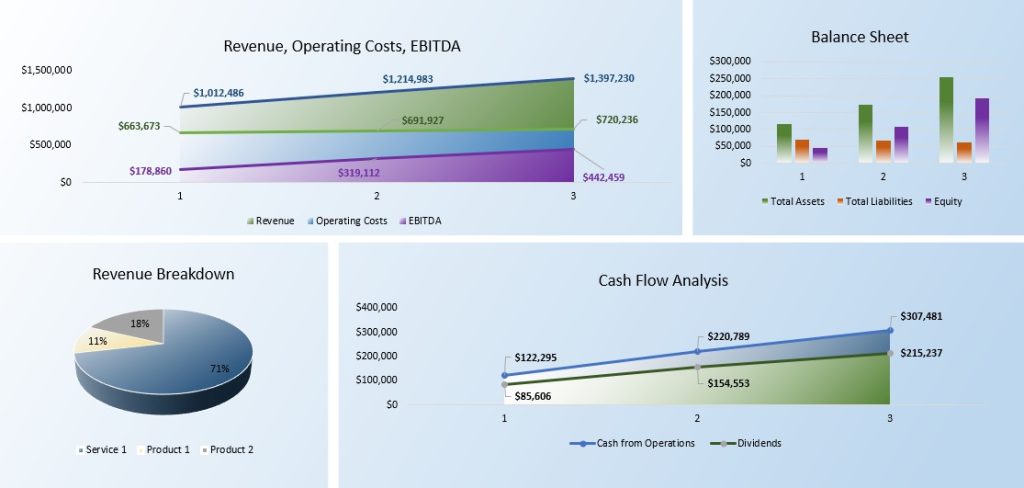

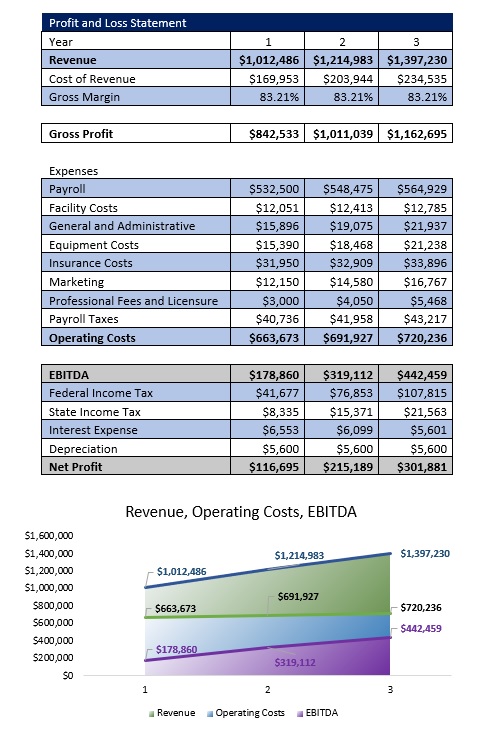

Mr. Doe expects a strong rate of growth at the start of operations. Below are the expected financials over the next three years.

1.6 Expansion Plan

The Founder expects that the business will aggressively expand during the first three years of operation. Mr. Doe intends to implement marketing campaigns that will effectively target individuals that are in need of bail bonds after they have been arrested and need to post bail.

2.0 Company and Financing Summary

2.1 Registered Name and Corporate Structure

Bail Bonding, Inc. The Company is registered as a corporation in the State of New York.

2.2 Required Funds

At this time, Bail Bonding, Inc. requires $100,000 of equity funds. Below is a breakdown of how these funds will be used:

2.3 Investor Equity

Mr. Doe is seeking to sell a 45% equity interest in the business in exchange for the capital required in order to launch the operations of Bail Bonding, Inc.

2.4 Management Equity

John Doe owns 100% of Bail Bonding, Inc. This capital structure will change once the requisite capital has been raised.

2.5 Exit Strategy

If the business is very successful, Mr. Doe may seek to sell the business to a third party for a significant earnings multiple. Most likely, the Company will hire a qualified investment bank to sell the business on behalf of the Bail Bonding. Based on historical numbers, the business could fetch a sales premium of up to 4 times earnings.

3.0 Products and Services

Below is a description of the bail bonding services offered by Bail Bonding, Inc.

3.1 Bail Bonding Services

As discussed in the executive summary, the primary revenue center for the business will come from the ongoing bail bonding services provided to people that have been arrested and are in need of bail funding. The business will charge an amount equal to 10% to 12% of the face value of the bail amount set by the court. The Company, in all instances, will ensure that proper contracts are in place in the event that an individual flees. This will ensure that the Bail Bonding, Inc. business can recover the funds that were provided to secure the release of someone who has been arrested. At all times, Bail Bonding, Inc. will maintain the appropriate licensure in order to act in a bail bonding capacity.

3.2 Bounty Hunter Services

The Bail Bonding business’ secondary revenue center will come from bounty hunting for other businesses that are engaged in the bail bonding industry, but do not have a licensed bounty hunter on staff in the event that a client flees from their obligations to court. Fees received from this service will be based on the amount recovered when the person is found and taken back into custody.

4.0 Strategic and Market Analysis

4.1 Economic Outlook

This section of the analysis will detail the economic climate, the Bail Bonding industry, the customer profile, and the competition that the business will face as it progresses through its business operations. At this time, the economy is coming out of its recession. The job market has improved, and businesses are beginning to make investments into expansion. As such, the demand among companies that are seeking capital to expand its immense. Since people are arrested in any economic climate (and usually more so during times of economic recession), the business will be able to remain profitable and cash flow positive at all times.

4.2 Industry Analysis

Within the United States, there are 3,500 companies that are actively engaged in the business of providing bail bonding services. The industry generates approximately $1.2 billion of revenue per year while concurrently providing jobs to more than 15,000 people. Annual payrolls in each of the last five years have exceeded $250,000,000. The industry growth rate is expected to remain in lockstep with that of the general economy. With the exceptions of four states (Illinois, Kentucky, Oregon, and Wisconsin), all states currently allow for some level of bail bonding or bounty hunting. At this time, no pending legislation appears to limit the scope of practice in any other state.

4.3 Customer Profile

Bail Bonding, Inc.’s average client will be someone that does not have the proper capital to secure their release from jail. Below is an overview of the demographics anticipated by the Company: • Is based in the New York metropolitan area. • Has been arrested for a misdemeanor or felony offense. • Will spend $1,000 to $10,000 on Bail Bonding Services.

4.4 Competitive Analysis

This is one of the sections of the business plan that you must write completely on your own. The key to writing a strong competitive analysis is that you do your research on the local competition. Find out who your competitors are by searching online directories and searching in your local Yellow Pages. If there are a number of competitors in the same industry (meaning that it is not feasible to describe each one) then showcase the number of businesses that compete with you, and why your business will provide customers with service/products that are of better quality or less expensive than your competition

5.0 Marketing Plan

Bail Bonding, Inc. intends to maintain an extensive marketing campaign that will ensure maximum visibility for the business in its targeted market. Below is an overview of the marketing strategies and objectives of Bail Bonding, Inc.

5.1 Marketing Objectives

- • Maintain a strong database of bounty hunters that can assist the business with exponential growth over the next three years of operation.

- • Develop a broad range website that showcases the licensure and bail bonding services rendered by the business.

- • Establish relationships with area criminal defendant attorneys.

5.2 Marketing Strategies

Mr. Doe intends on using a number of strategies that will aggressively showcase the Bail Bonding available through Bail Bonding, Inc. These advertisements will focus on the local New York metropolitan market. The marketing messages to be used by the business will focus on the experience of the Company’s bail bonding services while concurrently ensuring quick releases for people that have been arrested. The business will also develop a highly informative website that shows the operations of the business, its bail bonding services, and how an individual can become a customer of Bail Bonding, Inc.

5.3 Pricing

In this section, describe the pricing of your services and products. You should provide as much information as possible about your pricing as possible in this section. However, if you have hundreds of items, condense your product list categorically. This section of the business plan should not span more than 1 page.

6.0 Organizational Plan and Personnel Summary

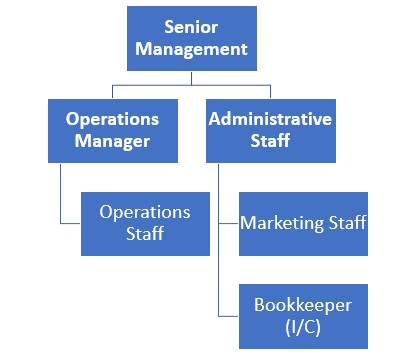

6.1 Corporate Organization

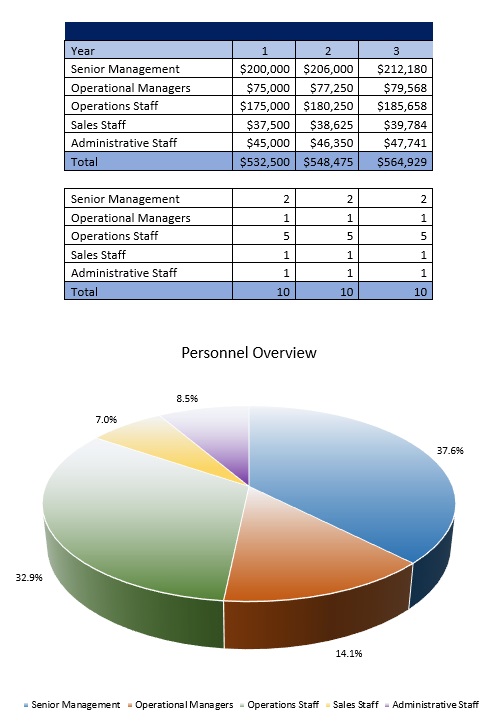

6.2 Organizational Budget

7.0 Financial Plan

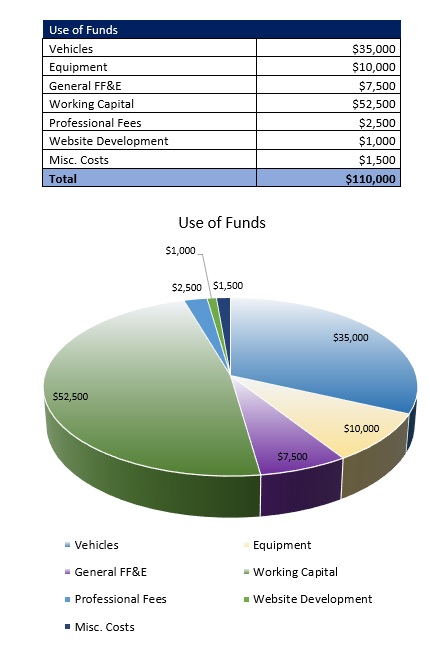

7.1 Underlying Assumptions

- • Bail Bonding, Inc. will have an annual revenue growth rate of 16% per year.

- • Management will acquire $100,000 of investor funds to launch the operations of Bail Bonding, Inc.

- • Management will settle most short term payables on a monthly basis.

7.2 Sensitivity Analysis

In the event of an economic downturn, the business may have a decline in its revenues. However, bail bonding businesses tend to thrive in times of economic difficulty as more people tend to commit crimes during recessions. As such, Bail Bonding, Inc. will be able to remain profitable and cash flow positive at all times.

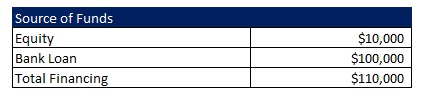

7.3 Source of Funds

7.4 Profit and Loss Statement

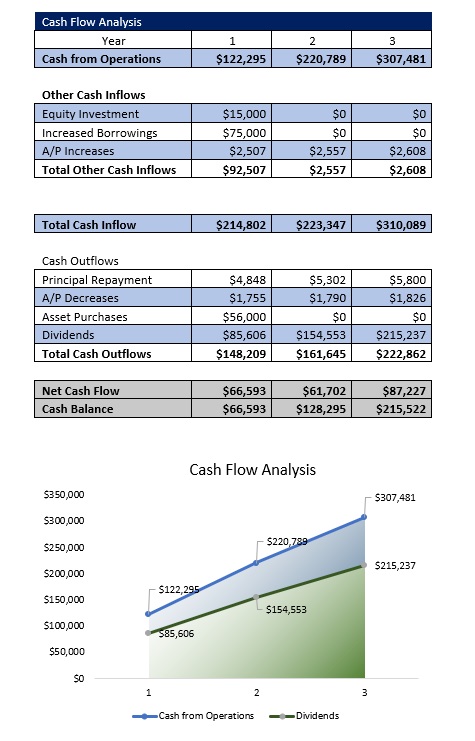

7.5 Cash Flow Analysis

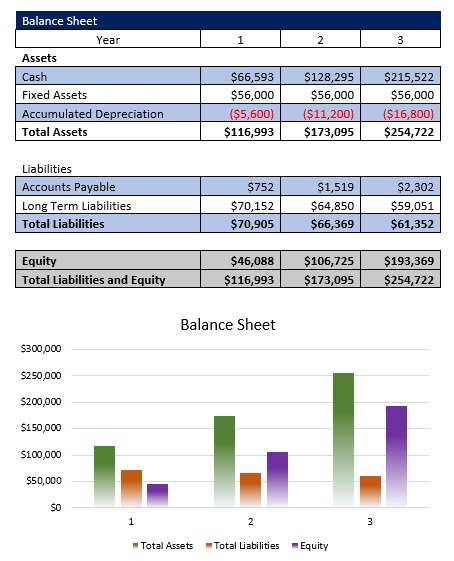

7.6 Balance Sheet

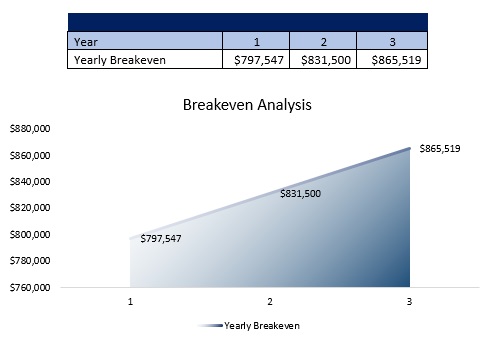

7.7 Breakeven Analysis

7.8 Business Ratios