Please note that the financials in this complete free business plan are completely fictitious and may not match the text of the business plan below. This free business plan demonstration purposes only. If you are interested in purchasing the completed editable MS Word and Excel documents for this business plan, please click the button below! Also, the text of the business plan is formatted with a fully automated table of contents.

1.0 Executive Summary

The purpose of this business plan is to raise $100,000 for the development of an independent escrow service company while showcasing the expected financials and operations over the next three years. Escrow Service, Inc. (“the Company”) is a New York based corporation that will provide sales of escrow services to the general public with a specific focus towards real estate transaction. The Company was founded by John Doe.

1.1 Operations

Escrow Service, Inc. is actively engaged in the business of providing services relating to the closing of real estate transactions throughout the State of New York. The business provides escrow services, document preparation endorsements, notary services, and other related services. Management uses a broad network of accountants, attorneys, real estate agents, and mortgage firms for referrals. The third section of the business plan will further describe the services offered by the Escrow Service.

1.2 The Financing

Mr. Doe is seeking to raise $100,000 from as a bank loan. The interest rate and loan agreement are to be further discussed during negotiation. This business plan assumes that the business will receive a 10 year loan with a 9% fixed interest rate.

1.3 Mission Statement

It is the goal of the Company to provide clients with the highest quality escrow services available to people within its target market.

1.4 Management Team

The Company was founded by John Doe. Mr. Doe has more than 10 years of experience in the real estate industry. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

1.5 Sales Forecasts

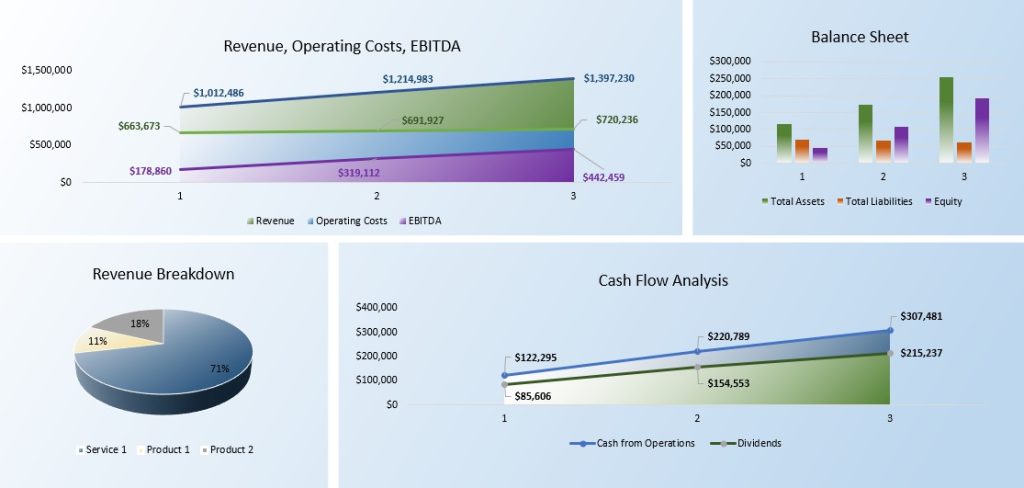

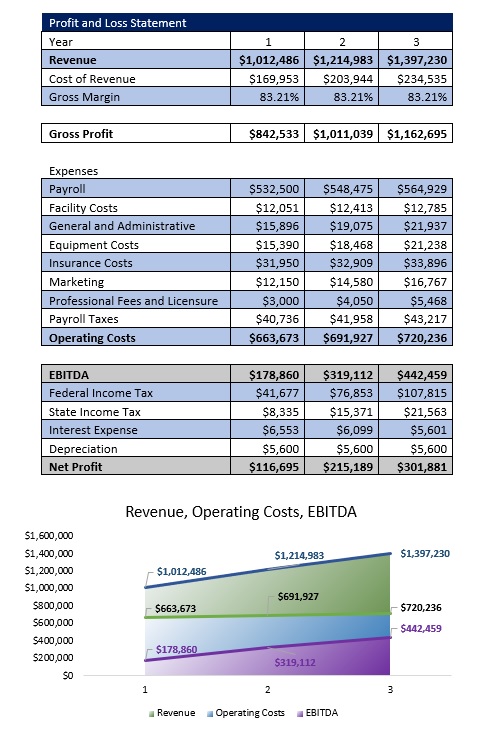

Mr. Doe expects a strong rate of growth at the start of operations. Below are the expected financials over the next three years.

1.6 Expansion Plan

The Founder expects that the business will aggressively expand during the first three years of operation. Mr. Doe intends to implement marketing campaigns that will effectively target individuals and real estate agents within the target market.

2.0 Company and Financing Summary

2.1 Registered Name and Corporate Structure

Escrow Service Company, Inc. The Company is registered as a corporation in the State of New York.

2.2 Required Funds

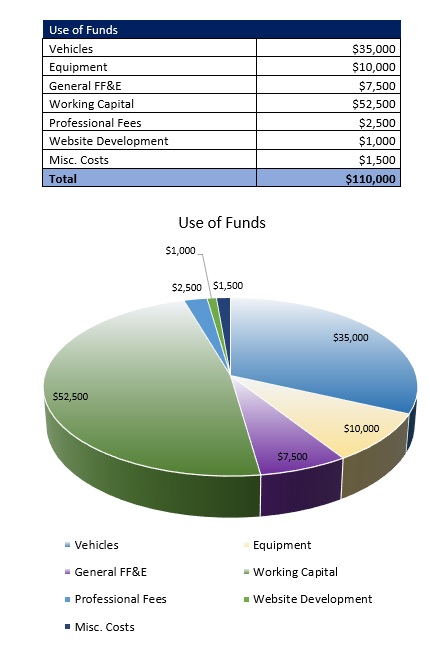

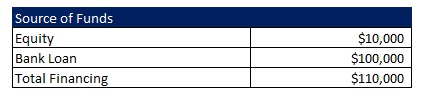

At this time, the Escrow Service requires $100,000 of debt funds. Below is a breakdown of how these funds will be used:

2.3 Investor Equity

Mr. Doe is not seeking an investment from a third party at this time.

2.4 Management Equity

John Doe owns 100% of the Escrow Service, Inc.

2.5 Exit Strategy

If the business is very successful, Mr. Doe may seek to sell the business to a third party for a significant earnings multiple. Most likely, the Company will hire a qualified business broker to sell the business on behalf of the Escrow Service. Based on historical numbers, the business could fetch a sales premium of up to 4 times earnings.

3.0 Operations

Below is a description of the services offered by Escrow Service, Inc.

3.1 Escrow Services

The Company will specialize in providing escrow services for individuals and companies that are engaging in large scale transaction that require a third party disinterested escrow service to ensure that the terms of agreement are met. The business will be licensed by the State of New York to render these services to a number of real estate brokerages, attorneys, business brokers, mortgage companies, and other businesses engaged in large scale financial transactions. The business will charge a flat fee of 1% of the aggregate transaction in exchange for ongoing escrow services.

3.2 Notary and Miscellaneous Services

As part of the legal real estate closing process, Escrow Service, Inc. also provides notary and document preparation services to ensure that the real estate closing is done within the complete letter of the law.

4.0 Strategic and Market Analysis

4.1 Economic Outlook

The business of escrow services is a relatively straightforward business that has moderate operating concerns. The business’s revenues are directly tied to the strength of the national real estate markets, and as such, there are several concerns that need to be addressed as the Company progresses through its business operations. Currently, the housing market (and the general economy) is going through a major pricing correction, although there are many indicators showing that the market is hitting its bottom. Last year, there was an unexpected increase in new housing starts and housing sales. Additionally, real estate investors have begun to buy many undervalued properties on a nationwide basis with the assumption that housing prices have declined past their true intrinsic value. This presents companies like Escrow Service, Inc. with the opportunity to capitalize on not only on the housing foreclosures that must have escrow services, but also among real estate buyers that need escrow services to facilitate purchases.

4.2 Industry Analysis

Escrow companies provide services that are extremely important to any real estate closing. Every lender requires that an escrow company is retained before any real estate closing can occur. As such, these businesses maintain a strong economic position within the real estate market. Nationwide, there are over 25,000 businesses that act as agent for escrow services. These businesses usually maintain several satellite offices. Each year, these businesses generate in excess of $5 billion dollars of revenue from escrow services, document preparation, and notary fees. Additionally, the barriers to entry among these businesses is very low, and new market agents can enter markets quickly after filing the proper documentation and receiving the proper licensure in any given jurisdiction

4.3 Customer Profile

Escrow Service, Inc.’s average client will be a middle to upper middle class man or woman living in the Company’s target market. Common traits among clients will include: • Is purchasing a home with a value of $200,000 to $400,000 • Escrow Service is required by their lender • Household income of $65,000 to $100,000

4.4 Competitive Analysis

This is one of the sections of the business plan that you must write completely on your own. The key to writing a strong competitive analysis is that you do your research on the local competition. Find out who your competitors are by searching online directories and searching in your local Yellow Pages. If there are a number of competitors in the same industry (meaning that it is not feasible to describe each one) then showcase the number of businesses that compete with you, and why your business will provide customers with service/products that are of better quality or less expensive than your competition.

5.0 Marketing Plan

Escrow Service, Inc. intends to maintain an extensive marketing campaign that will ensure maximum visibility for the business in its targeted market. Below is an overview of the marketing strategies and objectives of the Escrow Service.

5.1 Marketing Objectives

- Establish relationships with accountants and attorneys.

- Implement a local campaign with the Company’s targeted market via the use of flyers, local newspaper advertisements, and word of mouth.

- Develop an online presence by developing a website and placing the Company’s name and contact information with online directories.

5.2 Marketing Strategies

At the onset of operations, Mr. Doe intends to develop/expand his referral network from local accountants, attorneys, and regional real estate brokerages that will continually refer customers to the Escrow Service. Additionally, Management expects that local word-of-mouth referrals will also be an immense asset to the business as the Company expands its market reach into other areas of the target market. The business will also develop numerous relationships with local businesses and professional organizations. Management will also focus on developing the business name within the community by sponsoring a number of local events and remaining active in the community. Escrow Service, Inc. will also advertise via the Internet and through traditional print media for the local markets. This strategy will include listings in the local phone books and newspapers.

5.3 Pricing

In this section, describe the pricing of your services and products. You should provide as much information as possible about your pricing as possible in this section. However, if you have hundreds of items, condense your product list categorically. This section of the business plan should not span more than 1 page.

6.0 Organizational Plan and Personnel Summary

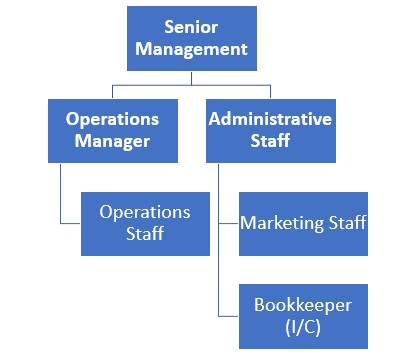

6.1 Corporate Organization

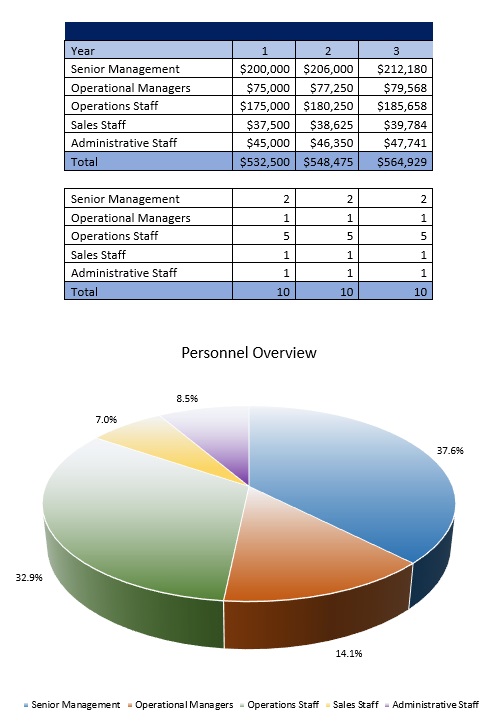

6.2 Organizational Budget

7.0 Financial Plan

7.1 Underlying Assumptions

- Escrow Service, Inc. will have an annual revenue growth rate of 16% per year.

- The Owner will acquire $100,000 of debt funds to develop the business.

- The loan will have a 10 year term with a 9% interest rate.

7.2 Sensitivity Analysis

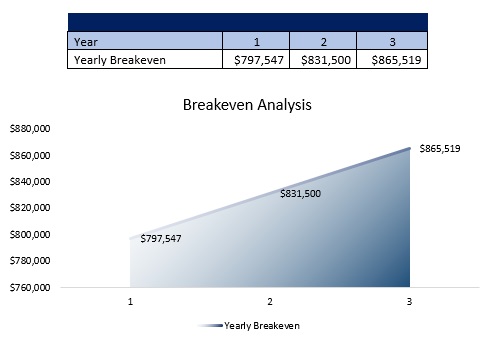

Escrow Service, Inc.’s revenues are sensitive to the general condition of the economy. The Company’s services demand that real estate or large scale financial transaction close in order to generate revenue. In times of low sales (like the current economic climate), the Company is certain to have a decrease in its top line income. However, the Company’s gross margins in relation to the operating costs of the business are extremely low, and the business will be able to survive a substantial decrease in business before the Company becomes unprofitable. However, this is unlikely as the real estate market has begun to show signs of correction.

7.3 Source of Funds

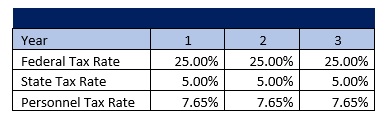

7.4 General Assumptions

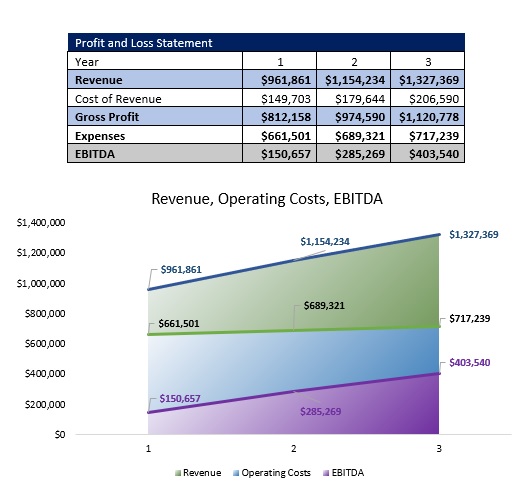

7.5 Profit and Loss Statement

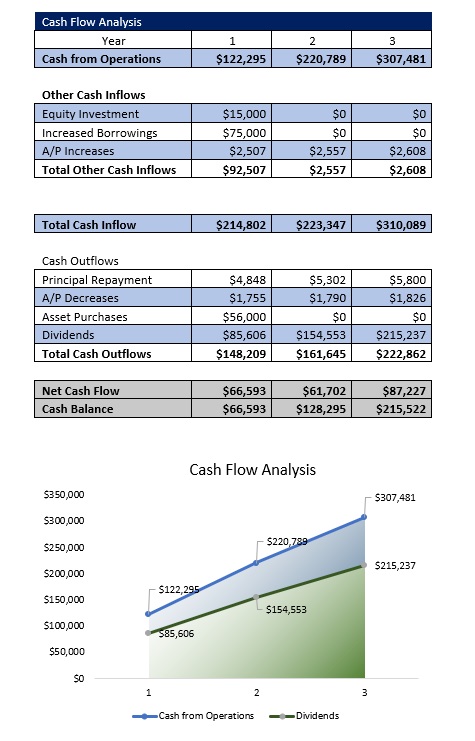

7.6 Cash Flow Analysis

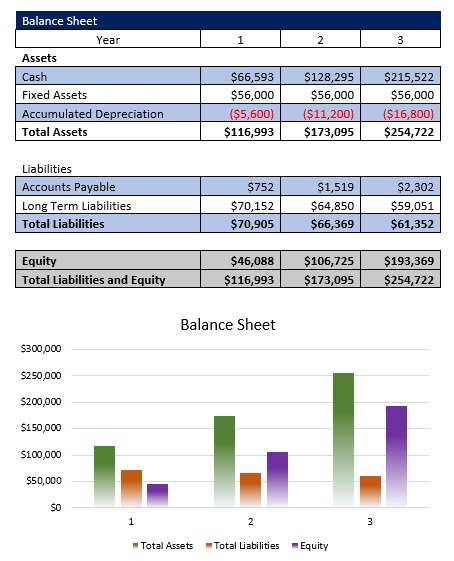

7.7 Balance Sheet

7.8 Breakeven Analysis

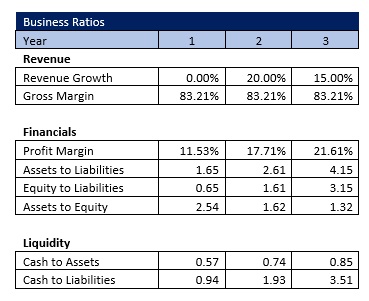

7.9 Business Ratios