Please note that the financials in this complete free business plan are completely fictitious and may not match the text of the business plan below. This free business plan demonstration purposes only. If you are interested in purchasing the completed editable MS Word and Excel documents for this business plan, please click the button below! Also, the text of the business plan is formatted with a fully automated table of contents.

1.0 Executive Summary

The purpose of this business plan is to raise $10,000,000 for the development of a mutual fund while showcasing the expected financials and operations over the next three years. Mutual Fund, Inc. (“the Company”) is a New York based corporation that will provide investments into marketable securities on behalf of investors. The Company was founded by John Doe.

1.1 Operations

The business, through its open ended mutual fund, will manage investments into marketable securities including stocks and bonds that are traded within the United States. At this time, Management is seeking to retain a qualified securities law firm that will draft the Company’s N-1A filing along with other appropriate filings so that the business can acquire its custodial accounts and begin soliciting capital from the general public. The Mutual Fund will generate assets under management fees equal to 1.5% of the total assets that are in the Mutual Fund. The third section of the business plan will further describe the services offered by the Mutual Fund.

1.2 The Financing

Mr. Doe is seeking to raise $10 million from a number of investors via a private placement offering that will be used to make investments into publicly traded companies. Primarily the financing will be used for the following: • Development of the Company’s Mutual Fund location. • Financing for the first six months of operation. • Financing for the investments to be made by the Mutual Fund.

1.3 Mission Statement

Management’s mission is to develop the Mutual Fund into a premier asset management firm that uses highly proprietary market research to determine the best companies for investment within the United States.

1.4 Management Team

The Company was founded by John Doe. Mr. Doe has more than 10 years of experience in the investment management industry. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

1.5 Sales Forecasts

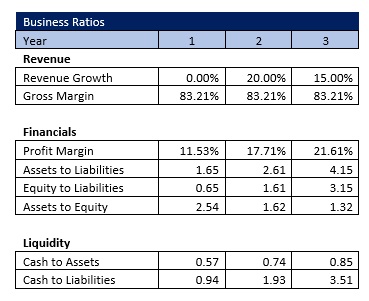

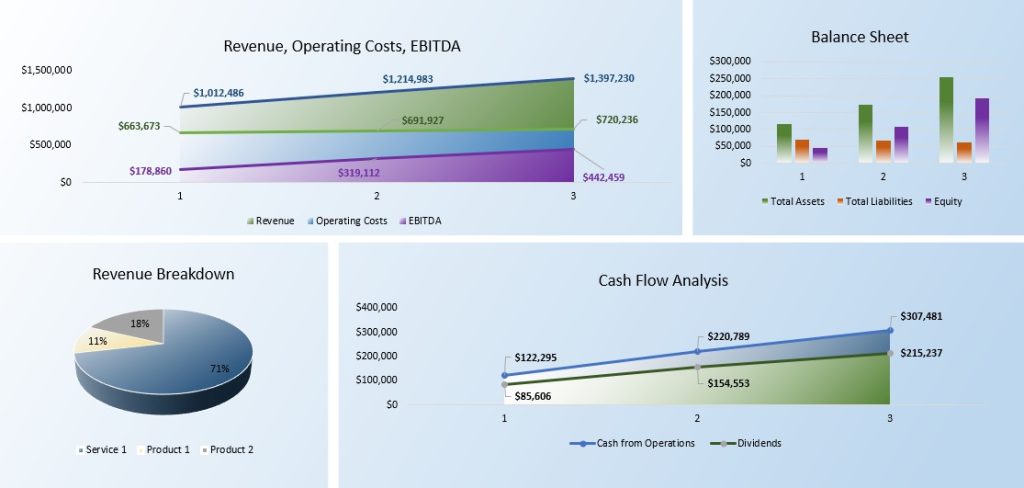

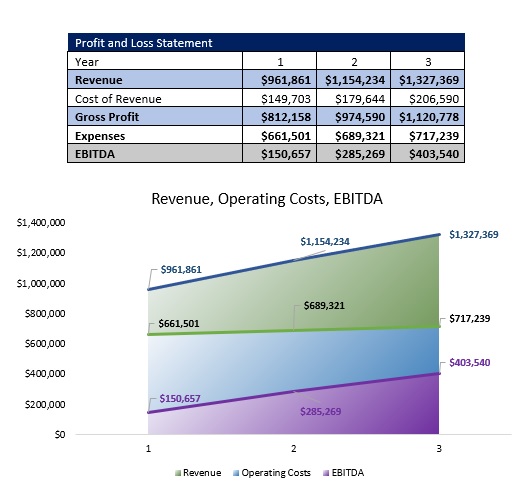

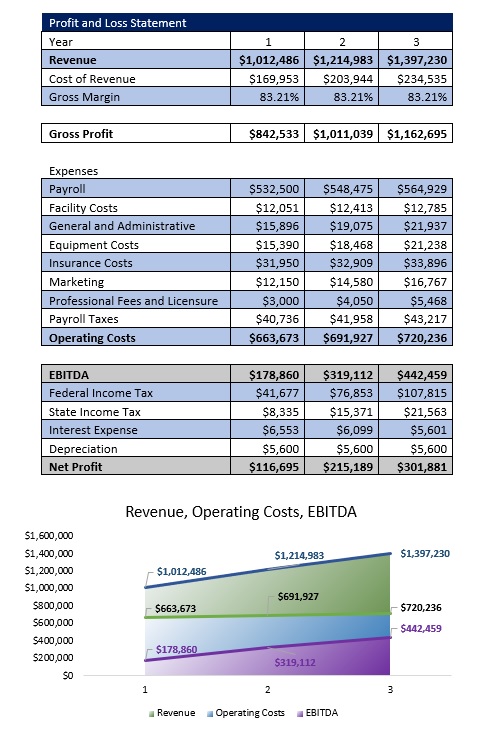

Mr. Doe expects a strong rate of growth at the start of operations. Below are the expected financials over the next three years.

1.6 Expansion Plan

The Founder expects that the business will aggressively expand during the first three years of operation. Mr. Doe intends to implement marketing campaigns that will effectively target investors and publicly traded companies within the target market.

2.0 Company and Financing Summary

2.1 Registered Name and Corporate Structure

Mutual Fund, Inc. The Company is registered as a corporation in the State of New York. All shares of investments will be held through a third party entity.

2.2 Required Funds

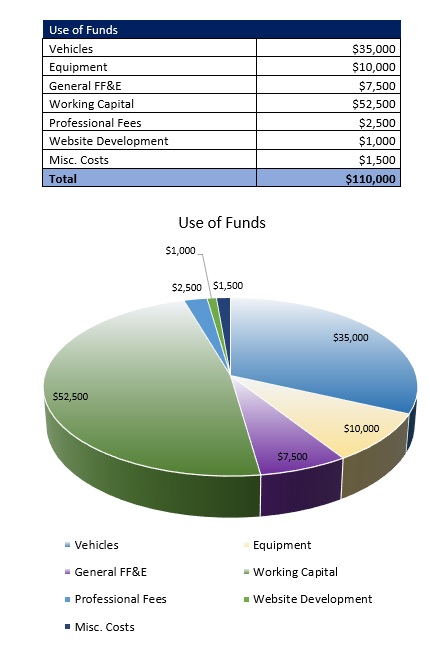

At this time, the Mutual Fund requires $10 million of investment funds funds. Below is a breakdown of how these funds will be used:

2.3 Investor Equity

Mr. Doe is seeking to raise capital via the Company’s private placement memorandum. He will retain a 100% ownership interest in the investment management company that will oversee the firm’s publicly traded stock investments.

2.4 Management Equity

This will be further discussed in the Company’s private placement memorandum.

2.5 Exit Strategy

If the business is very successful, Mr. Doe may seek to sell the business to a third party for a significant earnings multiple. In all likeliness, a qualified investment bank would be hired to manage the complex aspects of selling the Mutual Fund to a third party for a significant earnings multiple. We encourage you to review the Company’s PPM in regards to the potential sale of the Mutual Fund to a third party investor.

3.0 Operations

Below is a description of the mutual fund services offered by the Mutual Fund, Inc.

3.1 Assets Under Management Services

The primary revenue center for the business will come from the ongoing assets under management fees that will be received from the ongoing management of publicly traded securities that are bought and sold through the Company’s mutual fund. The business will focus on a number of different types of investment strategies including value and growth investing. The business will hire number of highly educated investment professionals that can provide insight into the economic viability of any business that is reviewed by the Mutual Fund for a potential investment.

4.0 Strategic and Market Analysis

4.1 Economic Outlook

This section of the analysis will detail the economic climate, the mutual fund industry, the customer profile, and the competition that the business will face as it progresses through its business operations. Currently, the economic market condition in the United States is moderate. The meltdown of the sub prime mortgage market coupled with increasing gas prices has led many people to believe that the US is on the cusp of a double dip economic recession.

4.2 Industry Analysis

The financial services sector has become one of the fastest growing business segments in the U.S. economy. Computerized technologies allow financial firms to operate advisory and brokerage services anywhere in the country. In previous decades, most financial firms needed to be within a close proximity to Wall Street in order to provide their clients the highest level of service. This is no longer the case as a firm can access almost every facet of the financial markets through Internet connections and specialized trading and investment management software. With these advances, several new firms have been created to address the needs of people in rural and suburban areas. The Bureau of Labor Statistics estimates that there are approximately 94,000 investment advisors currently employed throughout the United States. The average annual income for an investment advisor (including mutual fund employees) is $62,700. Salaries are expected to increase at a rate of 2.1% a year as inflation increases. In the last study conducted by the U.S. Economic Census, it was found that the revenues of the investment advisory industry increased from $14.8 billion dollars in 1999 to over $52.9 billion dollars by 2009. The number of investment advisory establishments increased 61.5% over the same period.

4.3 Customer Profile

As the Company intends to operate an open-ended mutual fund, any person will be able to make an investment into the business’ fund. However, Management has developed the following demographic profile of individual investors that will provide capital for the mutual fund:

• Between the ages of 35 and 65

• Annual household income of $60,000+

• Will invest $3,000 to $25,000 with the mutual fund.

Based on the above demographic profile, approximately 45 million Americans could become potential investors in the fund.

4.4 Competitive Analysis

As the investment advisory industry has grown, so has the level of competition. One of the drawbacks to the industry is that there are very low barriers to entry. Any individual or business may register itself as an investment advisor after completing the proper examinations and filings. The expected costs to build an investment advisory are low as it is a service oriented business. Success in this market will depend on several factors including: • The ability to create and market new and innovative products. • Generation of an outstanding track record for Mutual Fund, Inc. As stated earlier, there are more than 8,000 other mutual funds that operate in a similar capacity.

5.0 Marketing Plan

The Mutual Fund intends to develop a marketing campaign that will attract both investors and potential investment companies to the brand name of the firm. Below is an overview of these strategies.

5.1 Marketing Objectives

- Develop relationships with brokers throughout the United States.

- Develop a strong presence among funds of funds.

- Remain within the letter of law regarding the advertisements and marketing campaigns carried out by the Mutual Fund.

5.2 Marketing Strategies

Management intends to use a broad based marketing campaign that will target individual investors (or retail investors), investment institutions, other mutual funds, stock brokerages, and other firms that will invest capital into the Company’s open ended mutual funds. As this is a highly competitive industry, Management will hire a qualified investment focused marketing firm to assist in this process. These marketing firm will work closely with the Company’s Chief Compliance Officer and retained securities law firm to ensure that all advertisements are in line with the requirements set forth by the Securities and Exchange Commission. The Company will also maintain a highly informative website showcasing the operations of Mutual Fund, an outline of the Company’s mutual fund program, and how to contact the business for more information regarding the Company’s asset management services.. This website will also have a portal for investors to learn more about the Company’s operations and its investments.

5.3 Pricing

In this section, describe the pricing of your services and products. You should provide as much information as possible about your pricing as possible in this section. However, if you have hundreds of items, condense your product list categorically. This section of the business plan should not span more than 1 page.

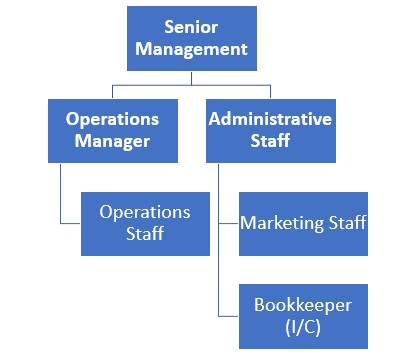

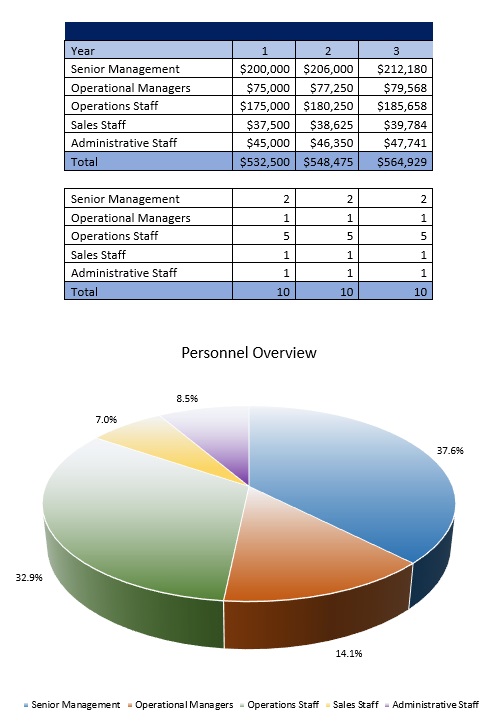

6.0 Organizational Plan and Personnel Summary

6.1 Corporate Organization

6.2 Organizational Budget

7.0 Financial Plan

7.1 Underlying Assumptions

- Mutual Fund will have an annual revenue growth rate of 16% per year.

- The Owner will acquire $10,000,000 of equity funds.

- The business will generate revenues equal to 1.5% of the total funds managed by the Company.

7.2 Sensitivity Analysis

The Company’s revenues are not sensitive to changes in the general economy or securities marketplace. The mutual fund intends to invest in a number of other mutual funds that produce profits despite deleterious stock market conditions.

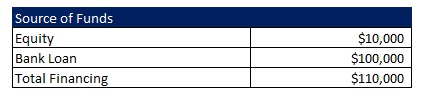

7.3 Source of Funds

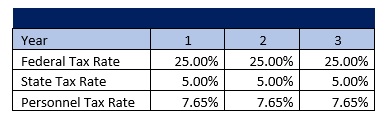

7.4 General Assumptions

7.5 Profit and Loss Statement

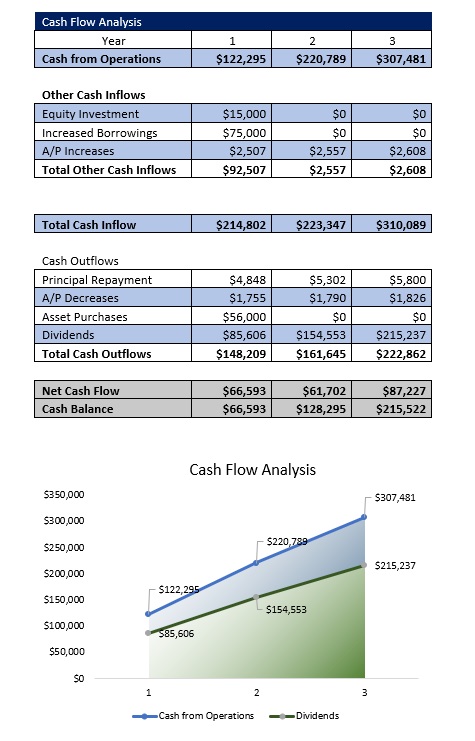

7.6 Cash Flow Analysis

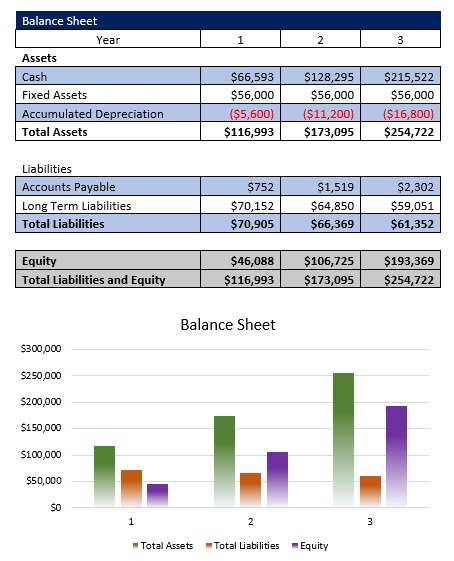

7.7 Balance Sheet

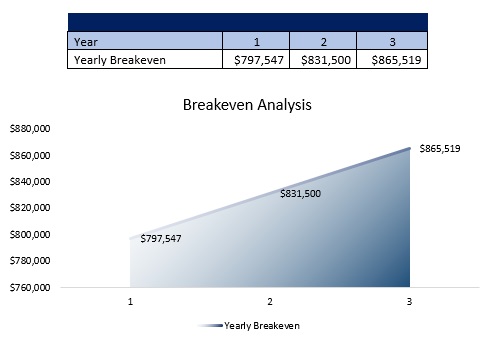

7.8 Breakeven Analysis

7.9 Business Ratios